GOLD Nível visado: 1769.7496

Bandeira quebrou na linha de suporte em 09-dez-2021 13:00 UTC. Possível previsão de movimento em baixa nos próximos 11 horas para 1769.7496

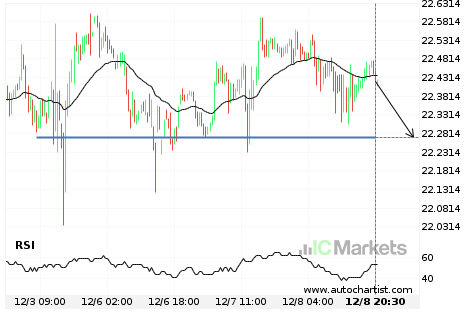

Grande Movimento SILVER

SILVER experimentou um 2.2% em baixa movimento no(a) último(a) 25 horas.

SILVER Nível visado: 22.2710

Aproximando-Apoiar nível de 22.2710 identificado em 08-dez-2021 20:30 UTC

GOLD Nível visado: 1787.7900

Cunha ascendente identificado em 08-dez-2021 09:30 UTC. Este padrão está ainda em processo de formação. Possível previsão de movimento em alta para o nível de 1787.7900 no próximo 8 horas.

SILVER Nível visado: 22.7680

Triângulo quebrou na linha de resistência em 07-dez-2021 05:00 UTC. Possível previsão de movimento em alta nos próximos dia para 22.7680

GOLD Nível visado: 1761.8700

Cunha descendente identificado em 06-dez-2021 21:00 UTC. Este padrão está ainda em processo de formação. Possível previsão de movimento em baixa para o nível de 1761.8700 no próximo 2 dias.

SILVER Nível visado: 22.9200

Canal descendente quebrou na linha de resistência em 03-dez-2021 21:00 UTC. Possível previsão de movimento em alta nos próximos 12 horas para 22.9200

GOLD Nível visado: 1794.2200

Aproximando-Resistência nível de 1794.2200 identificado em 03-dez-2021 18:00 UTC

SILVER Nível visado: 23.3100

Canal descendente identificado em 02-dez-2021 21:00 UTC. Este padrão está ainda em processo de formação. Possível previsão de movimento em alta para o nível de 23.3100 no próximo 2 dias.

GOLD Nível visado: 1808.7700

Cunha descendente identificado em 03-dez-2021 05:00 UTC. Este padrão está ainda em processo de formação. Possível previsão de movimento em alta para o nível de 1808.7700 no próximo 3 dias.